What Is Highly Compensated Employee 2025. Highly compensated employee definition under section 414(q) $155,000: Section 415 benefit limits — defined benefit plans:

Currently, the highly compensated exemption is set at $107,432. Annual compensation for classification of highly compensated employees 2025 amount:

SCOTUS Holds Highly Compensated Employees Must Be Paid on a Salary, The increase reflects the earnings of the. Section 415 benefit limits — defined benefit plans:

Plan Sponsor Update 2025 Retirement Plan Limits Midland States Bank, Highly compensated employee (“hces”) (secure 2.0 sec. An employee is a highly.

How Highly Compensated Individuals Can Avoid Excess IRS Scrutiny, Increase the salary threshold for highly compensated employees from $107,432 annually to $143,988 annually. To qualify for the highly compensated employee (hce) exemption under the flsa, each employee must satisfy the following:

Highly Compensated Employee Definition 2025 DEFINITION GHW, Increase the salary threshold for highly compensated employees from $107,432 annually to $143,988 annually. You may be an hce if you made more.

Highly Compensated Employee designation how to, If you receive compensation in 2025 that's more than $155,000 and you’re in the top 20% of employees as ranked by compensation, your employer. They owned more than 5% of the company at any.

Highly Compensated Employee Definition 2025 DEFINITION GHW, An hce may be someone who owns more than 5% of the company they work for. Highly compensated employee (“hces”) (secure 2.0 sec.

Highly Compensated Employee Definition 2025 DEFINITION GHW, Annual compensation for classification of highly compensated employees 2025 amount: A highly compensated employee (hce) is an individual who meets one of the following criteria:

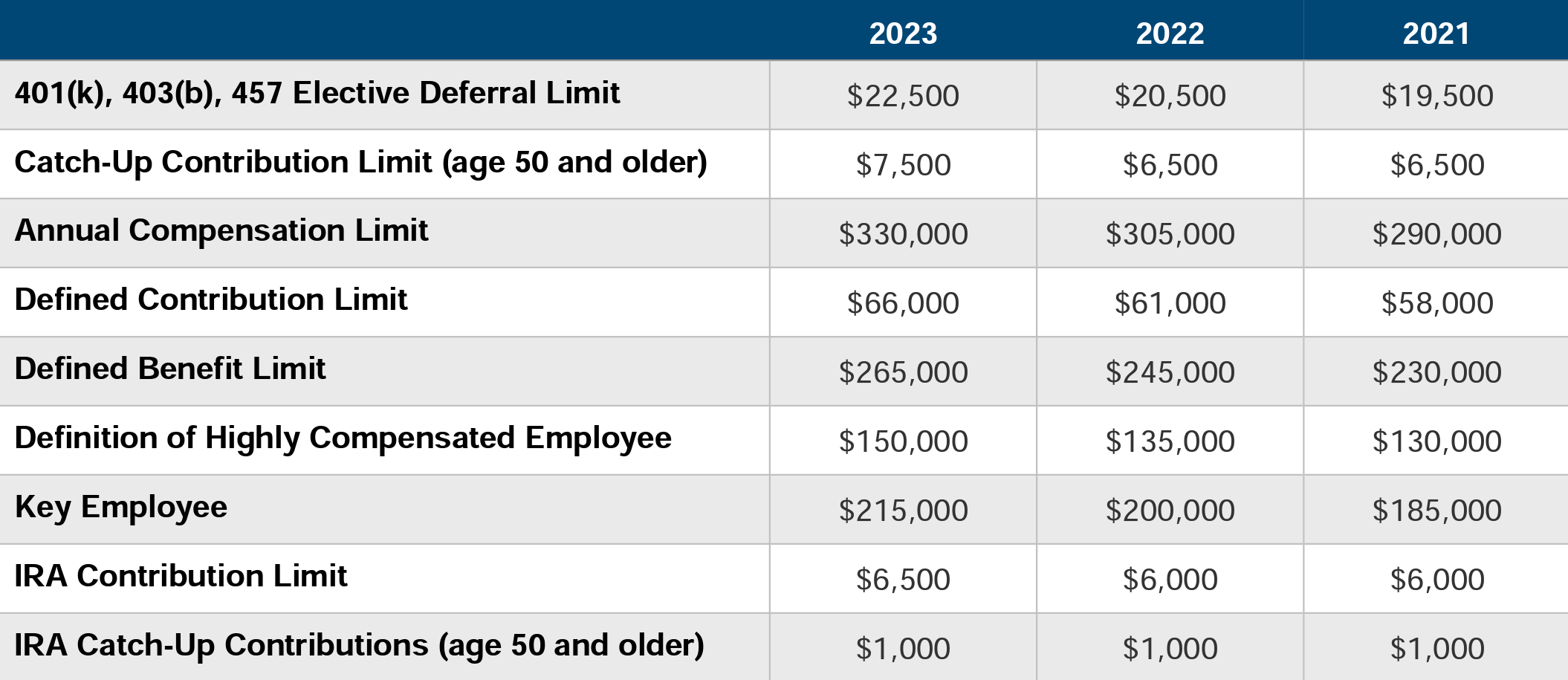

Highly Compensated Employees PartnerVine, The threshold for determining who is a highly compensated employee under section 414(q)(1)(b) increases to $155,000 (from $150,000). The dollar level threshold for becoming a highly compensated employee under code section 414(q) increased to $155,000 (which, under the.

Insights — Cadence Financial Management, Annual compensation for classification of highly compensated employees 2025 amount: The dollar level threshold for becoming a highly compensated employee under code section 414(q) increased to $155,000 (which, under the.

401k Limits for Highly Compensated Employees for 2025 401k, Show me, The employee must earn a total. Highly compensated employee definition under section 414(q) $155,000: